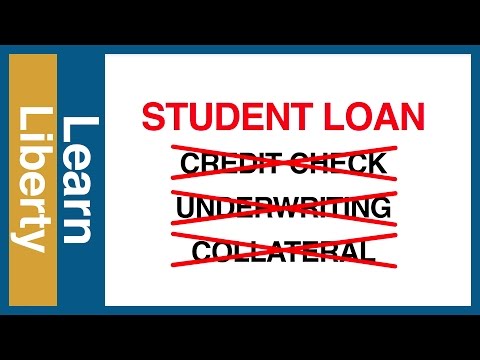

Student loans are difficult to repay in a sluggish economy, and many recent graduates are struggling under considerable debt. One proposal is forgiving student loans, but Prof. Daniel Lin argues that debt forgiveness does not resolve the underlying causes of rising student debt, and therefore cannot prevent future debt problems.Instead of debt forgiveness, Prof. Lin suggests making student loans like other types of loans: dischargeable in bankruptcy. This places the burden on lenders to ensure that students are not taking more debt than they can handle. While it would lead to a reduction in the amount of loan dollars awarded and increase interest rates, these are natural incentives that encourage borrowers to be more careful right now, and in the future, which puts pressure on colleges and universities to control their costs. According to Prof. Lin, making student loans dischargeable in bankruptcy is a good first step in reform aimed at resolving student debt and rising tuition costs.Follow us on Twitter @LearnLiberty: http://bit.ly/10gQVBQLike us on Facebook!: http://on.fb.me/XXx4IG

- Category

- Education

Be the first to comment